From MBA: Mortgage delinquencies will decrease slightly in Q3 2024, increasing on an annual basis

Mortgage delinquency rates for one- to four-unit residential properties decreased slightly to a seasonally adjusted 3.92% of total loan balances. According to a national survey by the Mortgage Bankers Association (MBA), delinquencies have increased as of the end of the third quarter of 2024 compared to a year ago.

The delinquency rate decreased by 5 basis points compared to the second quarter of 2024, but increased by 30 basis points compared to a year ago. The share of loans that entered into foreclosure rose 1 basis point to 0.14% in the third quarter.

“Mortgage delinquencies have been slowly increasing over the past year,” said Marina Walsh, vice president of industry analysis at CMB, MBA. “Overall delinquency rates decreased slightly in the third quarter compared to the previous quarter, driven by a decrease in 30-day delinquencies. Late-stage delinquencies increased last quarter and overall Delinquencies increased by 30 basis points compared to a year ago.

“Although delinquency rates remain low by historical standards, the composition of delinquent loans has changed, with more than 60 days delinquent across all major loan types compared to last quarter and a year ago,” Walsh said. “Delinquencies of 90 days or more are increasing,” he added.

Walsh also noted that the effects of Hurricanes Helen and Milton are likely to be felt in the National Delinquency Survey's next reporting period, given the timing of the storms in late September and early October.

Emphasis added

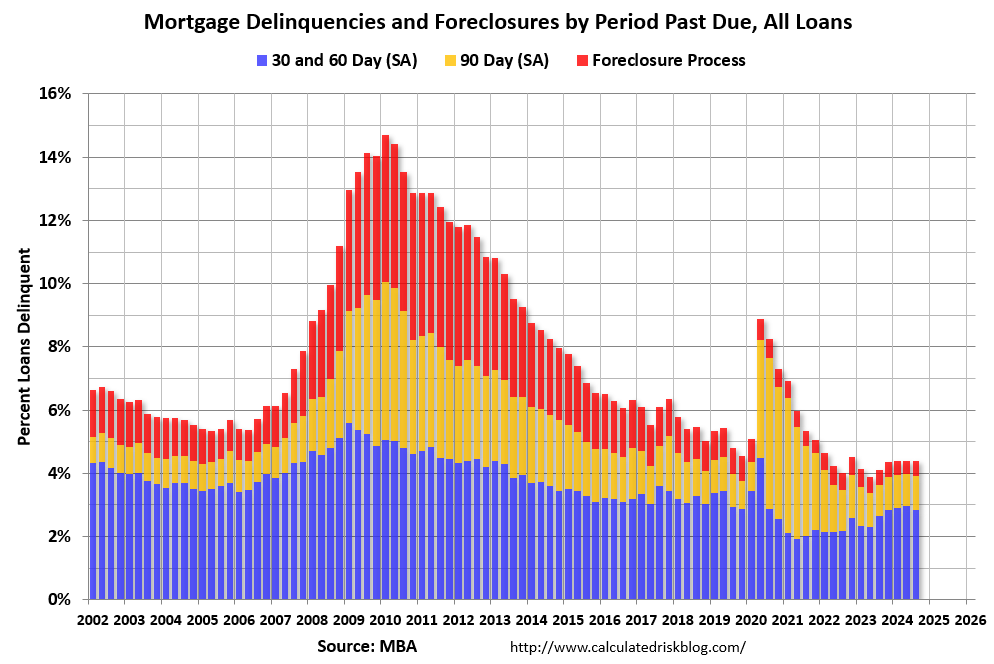

The following graph shows the percentage of past due loans by number of days past due. Overall delinquencies increased in the second quarter. The sharp increase in the 90-day bucket in 2020 was due to loans in forbearance (It will be included as a late payment, but will not be reported to the credit bureaus).

The percentage of loans in foreclosure proceedings decreased year over year from 0.49 percent in Q3 2023 to 0.45 percent (red) in Q3 2024, and remains at historically low levels.

Compared to the prior quarter, seasonally adjusted mortgage delinquency rates decreased across all loan balances. By stage, the 30-day delinquency rate decreased by 14 basis points to 2.12%, the 60-day delinquency rate increased by 3 basis points to 0.73%, and the 90-day delinquency rate increased by 7 basis points to 1.08%. %.

By loan type compared to the prior quarter, the total conventional loan delinquency rate decreased by 1 basis point to 2.63%. FHA's delinquency rate decreased by 14 basis points to 10.46 percent, and VA's delinquency rate decreased by 5 basis points to 4.58 percent.

On a year-over-year basis, total mortgage delinquencies increased for all loan balances. Delinquency rates increased 13 basis points for conventional loans, 96 basis points for FHA loans, and 82 basis points for VA loans year over year.

Delinquency rates include loans that are past due at least once, but do not include loans that are in foreclosure. At the end of the third quarter, the percentage of loans in foreclosure was 0.45%, up 2 basis points from the second quarter of 2024 and down 4 basis points from a year ago.

The seasonally unadjusted severe delinquency rate (the percentage of loans that are 90 days or more delinquent or in the process of foreclosure) was 1.55%. This was an increase of 12 basis points from the previous quarter and an increase of 3 basis points from last year. Severe delinquency rates rose 5 basis points for conventional loans, 46 basis points for FHA loans, and 19 basis points for VA loans from the previous quarter. Compared to a year ago, severe delinquency rates decreased by 3 basis points for conventional loans, increased by 29 basis points for FHA loans, and increased by 27 basis points for VA loans.

The five states with the largest quarterly increases in overall delinquency rates were Texas (24 basis points), Arkansas (14 basis points), Florida (13 basis points), Arizona (12 basis points), and Wyoming. state (9 basis points). .

The main concern is the rise in 30-day and 60-day delinquency rates, which, although historically low, have increased from 2.30% in Q2 2023 to 2.85% in Q3 2024. (Delinquency rates declined in the third quarter). I don't think this increase is anything to worry about, but it's worth noting.

We expect 30-day delinquencies to increase in the fourth quarter as a result of the hurricane.